10 Jun 2024 Estate Planning Q&A: Gifting to Intentionally Defective Grantor Trusts Explained

Authored by RSM US LLP, June 10, 2024

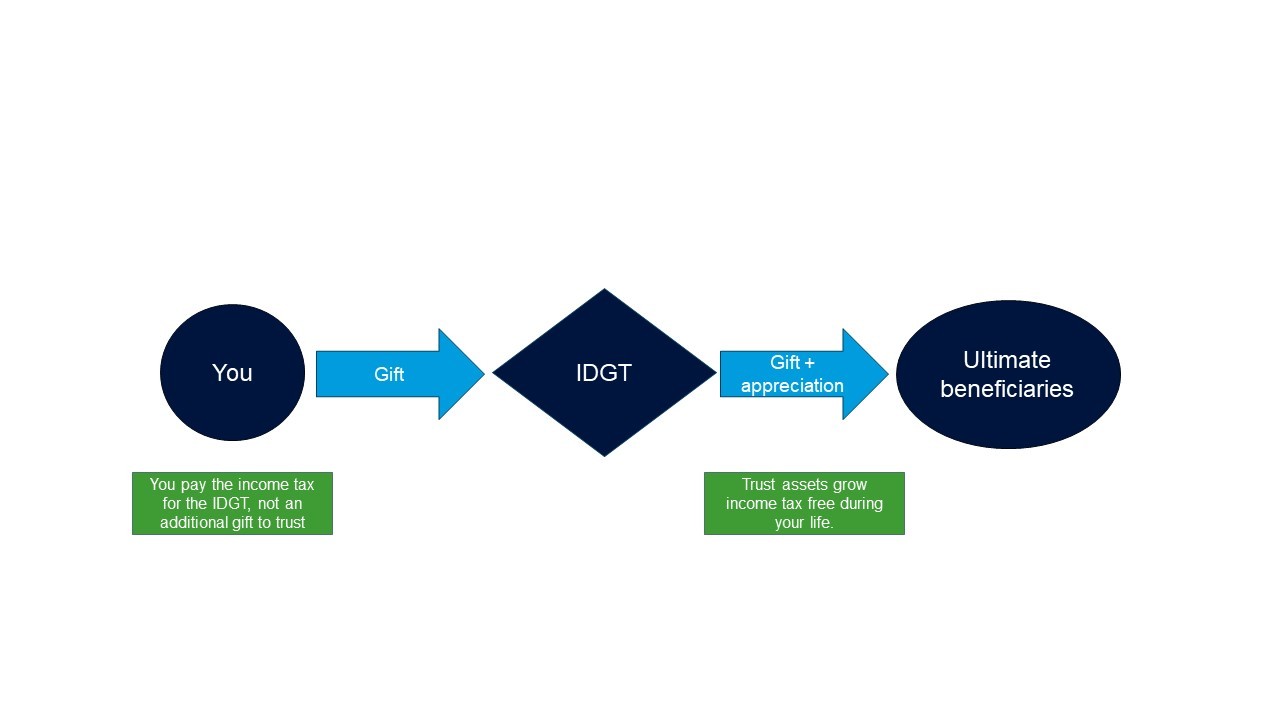

Despite the name, Intentionally Defective Grantor Trusts (IDGTs) are not necessarily ‘defective’ when it comes to your estate plan. In fact, IDGTs can be an incredibly useful and valuable estate planning vehicle. By strategically gifting assets to an IDGT, you can potentially reduce your taxable estate and provide long-term benefits for your family.

What is an IDGT?

An IDGT is a type of trust that has unique tax benefits. This is because it is treated differently for gift and estate tax purposes than it is for income tax purposes. This treatment is caused by powers you retain (for example, the ability to swap assets in and out of the IDGT in exchange for other assets you own of equal value).

- Income tax purposes: You are responsible for paying the income taxes on any income the assets in the IDGT generate. This means the assets inside the IDGT can grow without diverting IDGT assets to pay income taxes.

- Estate and gift tax purposes: When you transfer assets to an IDGT, they’re generally removed from your estate. You may use your gift tax exemption to avoid gift tax. Your payment of tax on the IDGT’s income is not an additional gift to the IDGT for gift tax purposes.

What are the requirements for gifting to an IDGT?

- The IDGT must be irrevocable. This means once you set it up, you generally cannot change the terms or get your assets back.

- For an IDGT to be considered ‘defective’ for income tax purposes (also called a ‘grantor trust’), the IDGT agreement must include specific powers that you retain. These powers allow you some indirect control, but not so much control that the IDGT assets are included in your estate for estate tax purposes. Some of the most common provisions include:

- The power to substitute assets owned by the IDGT with other assets of equal value.

- The power to borrow from the IDGT without adequate interest or security.

- The power to use IDGT income to pay premiums of life insurance policies on your life.

- The power to change the beneficiaries or the distributions that beneficiaries may receive.

- Designating your spouse as a beneficiary, or as a trustee and giving them the power to add beneficiaries.

What are the benefits of gifting to an IDGT?

- Any asset appreciation after the initial gift occurs outside of your estate.

- Paying income taxes on behalf of the IDGT not only enhances the growth of the IDGT assets, but also further reduces your estate.

- The power to substitute assets from the IDGT can provide flexibility if you are unsure of which assets to gift initially or if estate plans change down the road.

- Generally, IDGTs can even hold shares in S corporations.

What are the potential downsides of gifting to an IDGT?

- You must have additional sources of liquid income or wealth beyond the assets transferred to the IDGT to continue paying income taxes on the IDGT’s income.

- When your beneficiaries inherit the assets, they inherit the original tax basis you had. This might not be ideal for assets with low basis, meaning the beneficiaries could owe more capital gains tax when they eventually sell.

- You must file a gift tax return and (in most instances) obtain a professional appraisal to establish the transferred interest’s value for transfer tax purposes.

Is an IDGT right for you?

IDGTs can be a strategic way to transfer wealth today and allow that gift to grow exponentially outside your estate. If you anticipate your net assets exceeding the lifetime gift tax exemption and are able to continue paying the income taxes on transferred assets without any continuing cash flow from those assets, an IDGT could be the right strategy for you. By understanding the requirements, advantages, and potential downsides, you can make an informed decision about whether an IDGT is right for your estate planning needs. As always, consult with your RSM US tax advisor to tailor a strategy that best suits your situation and goals.

DO YOU HAVE QUESTIONS OR WANT TO TALK?

Fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Scott Filmore, Ashley Pye, Amber Waldman and originally appeared on 2024-06-10. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/services/business-tax/estate-planning-q-and-a-gifting-to-idgt-explained.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.