18 May 2022 Chart of the day: U.S. housing starts fall amid rising mortgage rates

Authored by RSM US LLP, May 18, 2022

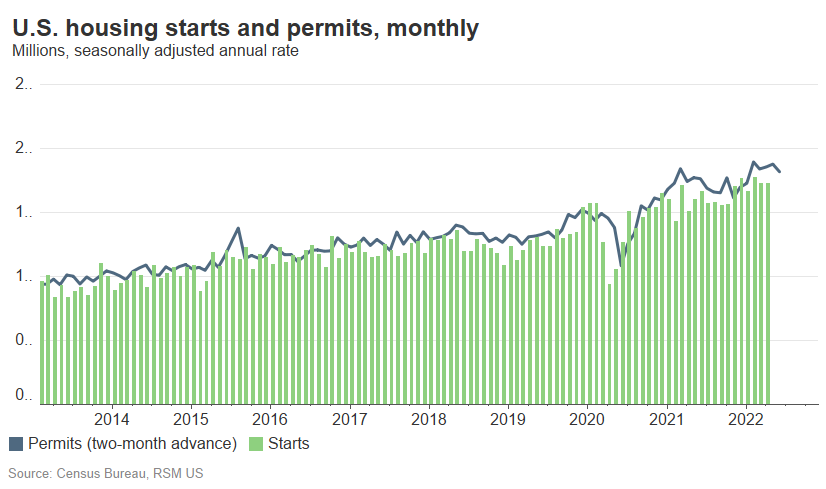

Construction of new houses in the United States slowed in April as builders’ sentiment soured on the spike in mortgage rates. Builders, expecting faster interest rate increases from the Federal Reverse to tackle inflation, are slowing down their plans for new supply.

With demand cooling off, we should expect new residential starts to fall back to the pre-pandemic trend rather quickly.

Housing starts fell by 0.2% on the month to 1.724 million annualized, according to the U.S. Census Bureau. March’s reading was revised downwardly from a 0.2% gain to a significant decrease of 2.8%. The decline in housing starts came from the single-family component, which fell by 7.3% on the month, while multi-family dwellings rose by a sharp 15.3%.

That did not take away from the underlying trend based on the six-month moving average—a much less volatile series—that showed housing starts at a fresh 16-year high in April. Elevated prices and robust demand in the past couple of months had incentivized developers to build more homes.

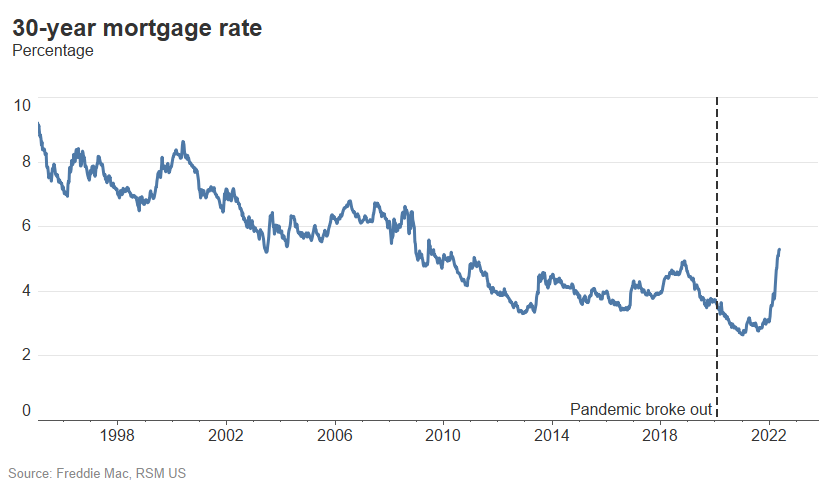

But mortgage rates, which had fueled such demand by staying historically low, are now rising rapidly. After surpassing 5% in April, the 30-year mortgage rate continued to rise higher, reaching 5.3% for the week ending May 13, according to data from Freddie Mac.

That caused builders’ sentiment to drop to the lowest level since June 2020, according to recent data from the National Association of Home Builders.

Building permits—a proxy for future starts—told the same story in April, falling by 3.2% on the month. Most permits become new housing starts within two months. Permits for both single-family and multi-family houses dropped in April.

Underneath the headline, April’s homes under construction rose steadily, by 1.6%, while completions dropped by 5.1%.

DO YOU HAVE QUESTIONS OR WANT TO TALK?

Fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Tuan Nguyen and originally appeared on 2022-05-18.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/chart-of-the-day-u-s-housing-starts-fall-amid-rising-mortgage-rates/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/aboutus for more information regarding RSM US LLP and RSM International. The RSM(tm) brandmark is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Haynie & Company is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.