09 Sep 2024 Estate Planning Q&A: Family Limited Partnerships Explained

Authored by RSM US LLP, September 09, 2024

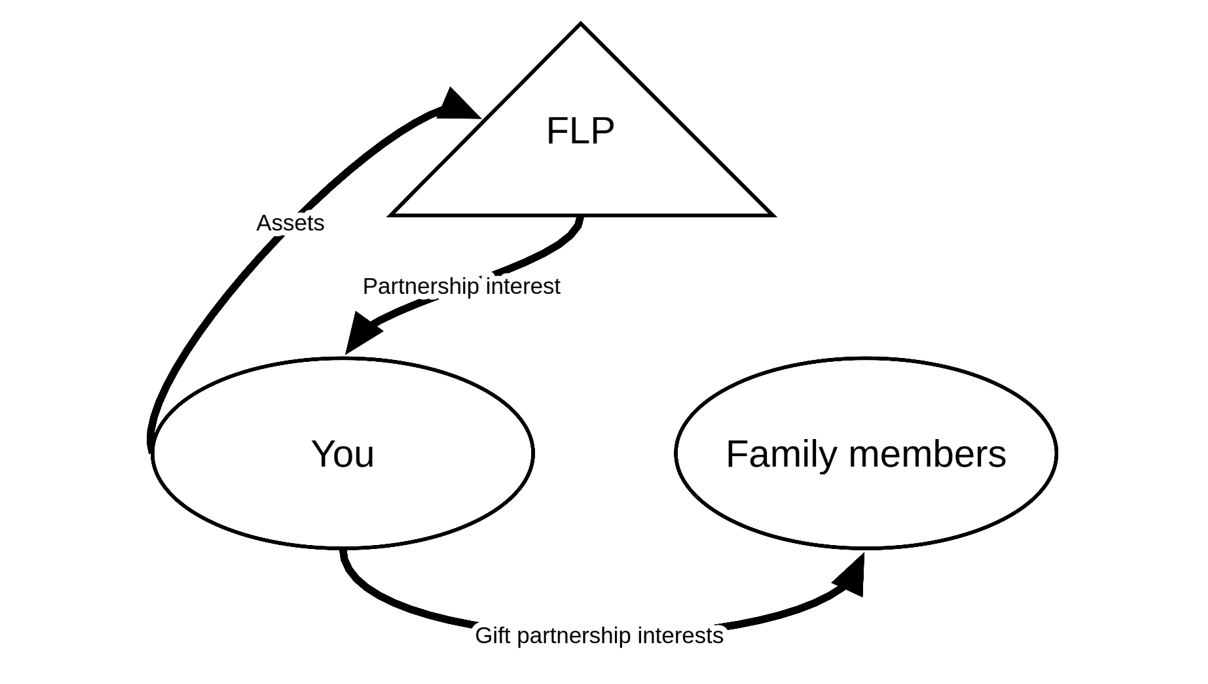

A Family Limited Partnership (“FLP”) is a valuable tool to transfer wealth out of your estate during life by transferring partnership interests to your family members.

What is a FLP?

A FLP is a partnership that creates a shared ownership structure for you and your family members. A FLP consists of a general partner, who runs the business and is liable for its debts, and limited partners, who are passive investors and are not liable for partnership debts. It is common for a FLP to pool resources of family members and operate as an investment entity or provide centralized management for multiple operating family businesses. After a FLP is funded, it can be used as an estate planning tool by gifting interests in the FLP to family members.

What are the benefits of utilizing a FLP?

- FLPs offer a centralized approach to managing family assets, simplifying administration and decision-making.

- The FLP structure provides the ability to gift ownership interests in the FLP, rather than the underlying assets themselves, which can protect assets from spendthrift beneficiaries, divorcing spouses and other financial risks.

- By taking advantage of valuation discounts on FLP interests, you can transfer more wealth out of your estate during life at a lower gift tax cost. Examples of these discounts include:

- Lack of marketability – applies to interests in FLPs because these interests are owned by family members privately. This discount considers the difficulty of selling the interest, compared with the ability to buy or sell interests in a publicly held company on the stock market.

- Lack of control – applies if you transfer a fractional, non-controlling interest in the FLP. This discount considers the inability to control the financial benefits of entity ownership, for example, the ability to control partnership distributions.

FLPs are passthrough entities which can help reduce the overall tax burden if interests are held by family members in lower tax brackets.

What are the potential downsides to utilizing a FLP?

- FLPs can be administratively complex to set up and manage.

- The IRS may scrutinize FLPs that appear to be primarily tax-driven or lacking legitimate business purposes.

- If you maintain significant control over the assets you transfer to the partnership, the IRS may consider those assets part of your taxable estate.

- There is a potential for family conflict due to differences in opinion about asset management or distribution among family members.

- The partnership structure can make it difficult to liquidate or transfer assets in the partnership quickly, which may be a concern in cases where liquidity is needed.

Is a FLP right for you?

A FLP can be a strategic way to gift during life by transferring ownership interests in the FLP instead of transferring the assets themselves.

Key considerations:

- Are you comfortable with the related loss of control over and potentially cashflow from the assets transferred to the FLP?

- Do you understand the potential valuation discounts and the factors that influence them?

- Will your FLP be structured and operated properly to avoid IRS scrutiny?

- Does a FLP align with your family’s goals, values and dynamics?

By understanding the benefits and risks of a FLP, you can make an informed decision about whether a FLP is right for your estate planning needs. As always, consult with your tax advisor to tailor a strategy that best suits your situation and goals.

DO YOU HAVE QUESTIONS OR WANT TO TALK?

Fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Scott Filmore, Amber Waldman, Alexa Larson and originally appeared on 2024-09-09. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/tax-alerts/2024/estate-planning-qa-family-limited-partnerships-explained.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.