10 Sep 2024 AI Hype vs. Reality: Assessing Short-Term Buzz and Long-Term Breakthroughs

Authored by RSM US LLP, September 10, 2024

Reality is setting in for artificial intelligence after many months of hype. Critical questions are arising for companies developing AI tools: What does your AI actually do, and what is the expected return on investment? How does your offering differentiate you from other companies offering similar tools?

While belief in the transformative potential of this technology remains strong, skepticism has grown. This relates to the idea of the hype cycle, which was developed by Gartner and includes five phases for emerging technologies, from innovation trigger to the plateau of productivity.

Background

According to Matthew Ball, CEO of Epyllion and angel investor, it is possible to pinpoint when a specific technology was created, tested or deployed, but identifying the onset of a new technological era is more elusive. Rather, after deployment, the technology often integrates into daily life in small ways that are not noticeable. Despite human skepticism, changes often build momentum, little by little, until it’s only apparent in hindsight that a new era has dawned.

The internet, for instance, has changed drastically since its creation in 1969. The initial network—with the acronym ARPANET—was revolutionary when several scientists combined their research, leading to the first communications from one computer to another. But it took decades of advancements and integration for a new era to truly emerge. The omnipresent connectivity of the internet is now.

Now, more than 50 years later, we are witnessing the rapid evolution of AI in real time. Amid a new technological revolution, how can we separate the true potential and use cases from hype?

Companies such as OpenAI have driven much of the popularity around the technology, and the excitement has transcended to private and public markets as businesses seek investment and other opportunities.

But some investors and consumers are wary, and skepticism goes beyond those groups. In March 2024, the U.S. Securities and Exchange Commission fined two investment advisers $400,000 for making “false and misleading statements about their purposed use of AI.”

Venture capital

Traditionally, software-as-a-service technology has been one of the most attractive sectors for venture capital investment. However, with the advent of ChatGPT in November 2022, AI has surged to the forefront. Valuations of private companies in the AI space are currently escalating more rapidly than those in the SaaS domain, according to data from PitchBook.

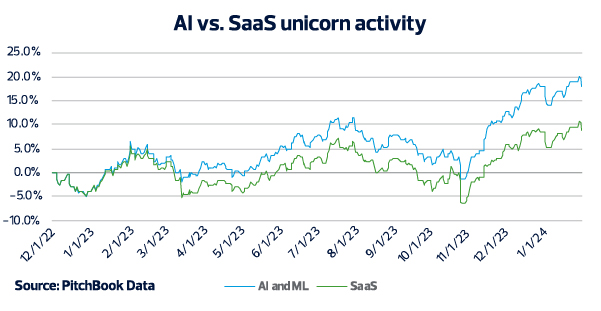

Furthermore, in 2024 through July, the average capital invested per venture capital deal is significantly higher than in previous years ($36.7 million in 2024 versus $24.5 million in 2020). This trend highlights a growing investor confidence and a willingness to commit more resources to AI, reflecting optimism about future returns. In addition, unicorn activity is also on the rise, at a much faster pace for AI companies than SaaS.

Public market

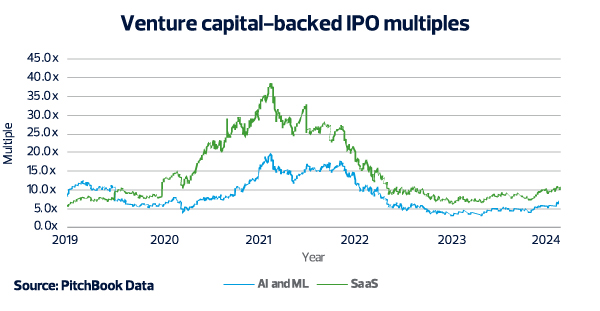

Despite a record number of venture capital-backed companies seeking exits, public listings have traditionally been rare, even under normal circumstances. The last two years have been the least favorable for initial public offerings in the past decade, leading to an accumulation of unrealized valuations. Contrary to the rising valuations and increased activity in the private market for AI businesses, publicly traded SaaS companies continue to command higher valuation multiples than their AI counterparts. While AI companies often present groundbreaking technology and potential, they may also carry higher risks and longer paths to profitability, leading to more conservative valuations in public markets.

For middle market businesses, AI offers significant opportunities to enhance internal operations, service offerings and brand recognition.

Technological development and adoption do not occur overnight—this is true for advancements from the internet to the iPhone. What’s more is that such developments typically do not come from one company alone but from a collaborative effort involving various companies, each contributing to technological progress.

Similarly, AI’s promise is apparent, but it is still in its early stages. AI’s supply chain and practical applications are drawing the attention of users, investors and companies. We should approach AI with excitement and caution as it progresses through the hype cycle. AI likely won’t take the decades it took the internet to bring in a new technological era, but it also won’t change our world overnight. Companies should continually assess their AI capabilities and gaps honestly, rather than buying into the hype cycle.

DO YOU HAVE QUESTIONS OR WANT TO TALK?

Fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Andrew Fedele, Justin Krieger and originally appeared on 2024-09-10. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/industries/technology-companies/ai-hype-versus-reality.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.