13 Mar 2023 Bank Term Funding Program: Government response to the banking crisis

Authored by RSM US LLP, March 13, 2023

With a crisis growing among the nation’s regional and midsize banks, the Federal Reserve, Treasury Department and Federal Deposit Insurance Corporation took decisive action over the weekend to stem a potential bank run.

The $25 billion Bank Term Funding Program, announced on March 12 after several days of mounting concern over the health of the nation’s banking system, was necessary to prevent a bank run that would almost certainly tip the economy into recession.

The lending program will help the nation’s small and midsize banks restore their balance sheets that now have unrealized losses in long-term, low-interest securities following aggressive rate increases by the Federal Reserve.

Under the program, if a bank owns bonds that are trading at 60 cents to the dollar, it can exchange those bonds at the Fed’s discount window for $1 in liquidity. effectively removing the risk of insolvency and a bank run.

What’s more, it potentially clears the way for the Fed to increase its policy rate by 25 basis points on March 22, at its next policy meeting.

But the Fed will want to strike a careful balance between restoring price stability and financial stability so soon after such an extreme event as the bank seizures.

“The primary policy objective of the BTFP is to restore confidence in the banking system and protect the real economy.”

The run-up

Bank runs cause real economic damage, and the action taken by the Fed, Treasury and FDIC intends to avoid a much larger and more expensive set of policies later.

The time to stop a bank run is before it begins. The absence of a “white knight” stepping forward over the weekend necessitated the large and decisive action taken.

The series of bank collapses and seizures in the days running up to the Fed’s announcement created the conditions for a classic run on banks that borrow short and lend long.

The mix of illiquid assets like business or mortgage loans and liquid liabilities like deposits, which may be withdrawn at any time, can easily give rise to self-fulfilling panics.

That is an apt description of the current moment and is what necessitated the creation of the $25 billion financing program.

At issue is the roughly $620 billion in unrealized losses sitting on the balance sheets of the nation’s banks. After a year of relentless increases in interest rates, many of these banks, particularly smaller and midsize institutions, sit on Treasury and agency-issued mortgage-backed securities that have lost value.

In the end, many depository institutions ended up borrowing short and lending long—what one might refer to as a carry trade—and the strategy imploded. With rates likely to move higher, perhaps to 6% by midyear, those unrealized losses will grow and could place other banks that adopted similar strategies under further stress.

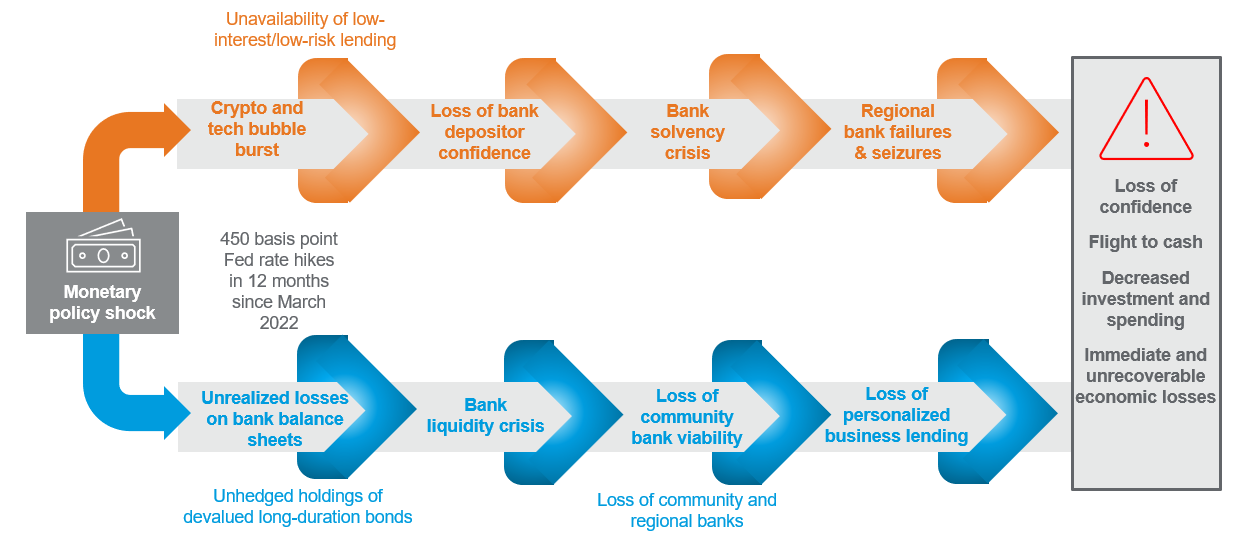

Confluence of an asset-bubble burst and a policy-shock, leading to a bank run, a flight to cash and a threat to economic growth

How the Bank Term Funding Program works

The primary policy objective of the BTFP is to restore confidence in the banking system and protect the real economy.

In our estimation the policy approach put forward is the appropriate framework to address a liquidity crisis.

The BTFP offers loans of up to one year to banks, savings associations, credit unions and other eligible depository institutions pledging U.S. Treasury bonds, agency debt and mortgage-backed securities, and other qualifying assets as collateral.

These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

Depository institutions may obtain liquidity against a wide range of collateral through the discount window, which remains open. In addition, the discount window will apply the same margins used for the securities eligible for the BTFP, further increasing lendable value at the window.

While all depositors will be made whole, shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

This is a policy put in place to protect deposits and is not a bailout of the bank, shareholders or debtholders.

The Federal Reserve also announced it will make available additional funding to eligible depository institutions to help ensure banks have the ability to meet the needs of all their depositors.

DO YOU HAVE QUESTIONS OR WANT TO TALK?

Fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Joe Brusuelas and originally appeared on 2023-03-13. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/economics/bank-term-funding-program-government-response-banking-crisis.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.