04 Jan 2022 1099 Reminder

Please be aware that your business is required to file the form 1099-NEC, Non-Employee Compensation, for each person, partnership, or LLC to whom you have paid $600 or more for services. This includes any payments in excess of $600 to an attorney for legal services (even if the attorney is incorporated).

Your business is also required to file Form 1099-MISC for any of the following during 2021:

- $600 or more in rents

- $600 or more in prizes and awards

- $600 or more in interest

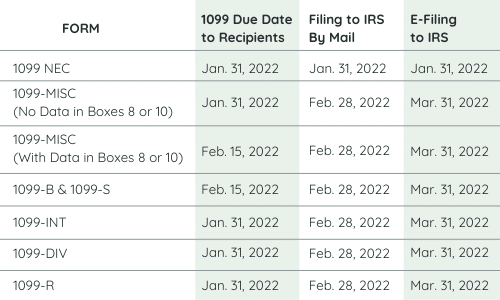

The due dates for the 1099’s are as follows:

If you believe you are required to file Forms 1099 based on the above descriptions, please review the IRS 1099 instructions.

If you need assistance preparing Forms 1099-NEC or 1099-Misc (with no data in boxes 8 or 10), send us your data by January 17th. For help with other 1099’s, send us your data by January 21st. Please do not hesitate to contact us for more information.